Ahead of next week’s earnings lineup, a few artificial intelligence (AI)-focused companies are set to release their quarterly results.

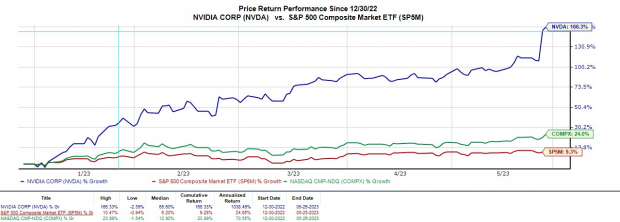

AI growth has continued to gain steam, fueled by chatGPT investors and consumer interest in recent months, with a dramatic rise in Nvidia shares (NVDA) this week. After beating Q1 top and bottom line expectations on Wednesday, Nvidia stock saw an extended rally as the company raised its Q2 earnings guidance due to strong demand for its AI chips.

This has many investors salivating for other stocks that offer future exposure to the AI realm. On that note, here are two stocks that investors may want to watch as earnings approach.

Image source: Zacks Investment Research

Dell Technologies (DELL)

Investors will be paying attention to Dell Technologies’ first quarter report on Thursday, June 1st. The popular technology solutions company is rapidly pushing into artificial intelligence. In fact, Dell has partnered with NVIDIA on the AI venture Project Helix.

Project Helix helps businesses use AI models to provide better customer service, market intelligence and enterprise research, among other capabilities. In this regard, Dell has created a portfolio of proven designs for AI to simplify IT infrastructure and deliver faster and deeper insights. In addition to AI, Dell recently launched new services and solutions to strengthen its cybersecurity portfolio.

Q1 Preview: Despite impressive AI advances, Dell is dealing with a tough operating environment largely due to weak demand for PCs and servers.

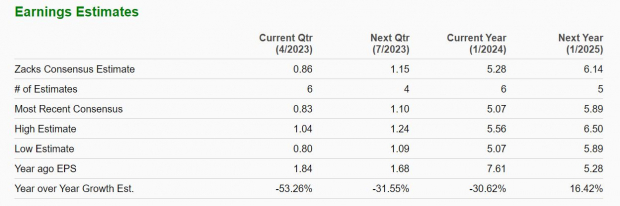

First-quarter earnings are projected at $0.86 per share, a 53% decrease from EPS of $1.84 compared to the prior quarter. On the top line, Q1 sales are expected to be $20.20 billion, down 22% from a year ago.

That being said, Dell has beaten earnings expectations for four consecutive quarters and raised its sales estimates in the last two quarterly reports.

Image source: Zacks Investment Research

Annual earnings are now forecast to decline -30% to $5.28 per share in Dell’s fiscal 2024, following a strong year with EPS of $7.61 in FY23. However, fiscal 2025 earnings are projected to rebound and jump 16 percent to $6.14 per share. Sales are expected to decline -16% in FY24 but will rebound and rise 5% to $90.53 billion in FY25.

Dell stock is up +20% this year, closely followed by the S&P 500’s +9% and IT Services Markets’ +7%, followed by the Nasdaq’s +24%.

Image source: Zacks Investment Research

C3.ai (AI)

As an enterprise artificial intelligence software company, Wall Street will track C3.ai’s growth and outlook in its fiscal fourth quarter report on Wednesday, May 31st.

In the year Founded in 2009, C3 is a company focused on accelerating digital transformation by developing and deploying large-scale AI, predictive analytics and IoT applications. C3 launched its IPO in 2020, and as the AI revolution accelerates, it looks like it’s slowly but surely on its way to crossing the profitability line.

Q4 Preview: The Zacks Consensus is for C3’s Q4 earnings of -$0.17 per share, versus an adjusted EPS loss of -$0.21 in Q4 2022. Fourth quarter sales are expected to be almost flat YoY at $72.32 million.

More interestingly, the C3 has beaten earnings expectations for 8 consecutive quarters and topped sales estimates in the last two quarterly reports.

Image source: Zacks Investment Research

C3’s annual earnings are now projected at $0.46 per share, up from an adjusted $0.73 per share in 2022. Fiscal 2024 earnings are expected to continue to approach the black at $0.33. Even better, it now forecasts sales to grow 5% this year and another 19% to $317.18 million in FY24.

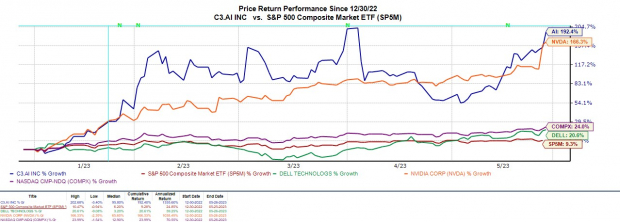

With so much optimism in the market around artificial intelligence, C3 stock is up +192% YTD with Dell and the broader indexes up to a high of Nvidia’s +166%.

Image source: Zacks Investment Research

at last

Going into their quarterly reports next week, Dell and C3 both earned a Zacks Rank #3 (Hold). Their quarterly estimates are not overwhelming, but exceeding expectations and giving positive guidance could cause DELL and C3 stocks to rally.

With high market sentiment in artificial intelligence, Dell and C3 shares may hold up for now as both companies are very attractive long-term investments.

5 stocks are set to double.

Each has been selected by Zacks Expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations increased by +143.0%, +175.9%, +498.3% and +673.0%.

Many of the stocks in this report are flying under Wall Street’s radar, providing a great opportunity to get in on the ground floor.

Today, check out these 5 potential home runs >>

Looking for the latest recommendations from Zacks Investment Research? Today, you can download 7 best stocks for the next 30 days. Click here to get this free report.

Dell Technologies Inc. (DELL): Free stock analysis report

C3.ai, Inc. (AI): Free stock analysis report

NVIDIA Corporation (NVDA): Free stock analysis report

Click here to read this article on Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]