On Friday, we moved our bias from Bullish/Neutral to Absolute Neutral as the market was trading at our first two pockets of resistance, which we identified in our morning reports as 595-601 and 606. those resistance levels. Needless to say, the market is at an inflection point, which should be an interesting open for the long weekend. If you haven’t already, be sure to click the “Subscribe” button below to receive our daily technical and fundamental commentary by email.

When the market sold off aggressively in mid-May, we were quite candid about the idea that the market might recover and enter a bit of a holding pattern. Below is a look at the current year (black line) and next month’s average July corn prices (vertical green line to vertical red line). Averages are derived from 5-, 10-, 15-, 20-, and 30-year averages.

Below is an updated look at the weekly Traders Commitment report.

Cooler and wetter weather just around the corner.

Click the link below to view the updated 6-10 day forecast and see how it stacks up to the 8-14 day.

6-10 Day Weather Forecast VS 8-14 Day Forecast – Blue Line Futures

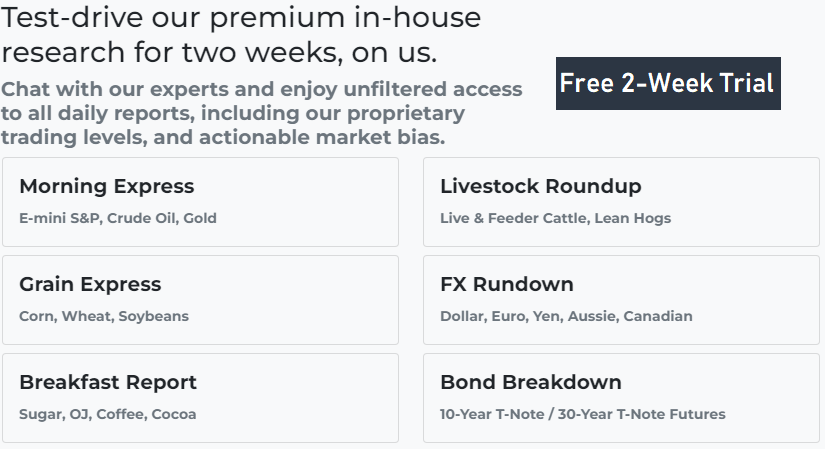

Sign up below for a FREE trial of our daily fundamental and technical grain commentary.

Futures trading involves significant risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such a trade is suitable for you, taking into account your financial situation. Trading advice is based on trading and statistical services and other sources that Blue Line Futures, LLC believes to be reliable. We do not warrant that such information is accurate or complete and as such should not be relied upon. Trading advice reflects our good faith judgment at the time and is subject to change without notice. There is no guarantee that the advice we give will result in a profitable trade. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of the NFA and is subject to NFA regulatory oversight and examinations. However, you should be aware that the NFA has no regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such a trade is suitable for you, taking into account your financial situation.

As cyberattacks increase, attacking companies in the healthcare, financial, energy and other government and global industries, Blue Line Futures wants you to be safe. Blue Line Futures will never contact you through a third party application. Blue Line Futures employees use only strong authorized email addresses and phone numbers. If you have been contacted by someone and would like to verify identity, please contact us info@bluelinefutures.com or call us at 312-278-0500

[ad_2]