An obvious trend in parking: large groups of end users are moving from cash payments directly to ‘mobile payments’. “This trend gives us a wealth of additional information, such as the actual parking duration of different types of parkers and their vehicles in different locations. Information that is very useful for parking facility management as well as policy enforcement.” A conversation with Ernst Bos, who moved from director of parking consultancy firm Spark to the same position at subsidiary data analytics company Monit Data.

“A logical step”, Bos explains. “We started with parking consultancy on Spark, and soon we were quite busy processing the wide variety of available parking data providing parking operators with data-driven insights. That’s why we built one data platform for the future for this purpose it can connect and process all kinds of current and future data sources and functions through connectors. This includes any parking operator, supplier, bank or independent MaaS provider. It has become an ICT company in its own right now processing parking data and payment transactions of approx 35 municipalities and various private parties in the Netherlands and abroad.”

“This payment transaction processing starts with the parking payment by cash, debit card, credit card or mobile app and ends only when the parking revenue is credited to the operator’s bank. This way we can take care of all the consolidation from receipt to payment. In addition, we track parking trends based on multiple data sources. We provide this ‘policy information’ to our customers, including a parking dashboard that can be consulted by all.”

Bos elaborates on the trend observed in parking fees: “The fact that cash payments are falling rapidly is certainly an obvious trend, because we all experience this in our daily behavior. But it is interesting to see where this development comes from and what are the expectations for the future. Based on the data from our platform, we can draw the following conclusions:

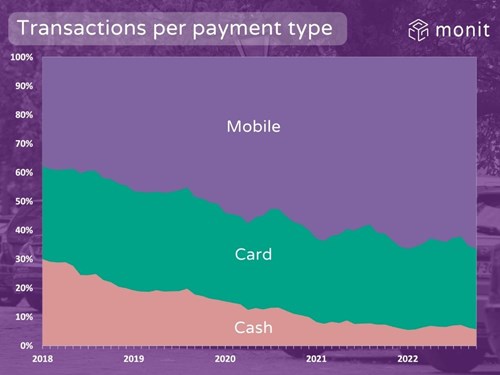

Trend in parking transactions by payment method for on-street parking.

part of mobile payments has grown over the past five years from roughly one-third of all parking charges to two-thirds. The result is a spectacular decline in the use of cash. However, the number of debit or credit card payments has remained more or less the same.

the number of cash payments it had already fallen to 10 percent at the end of 2020. This is about half compared to overall payment trends in the Netherlands; the use of cash was 21 percent in 2020. Therefore, the parking sector clearly leads other sectors in the decline of cash use. Today, the share of cash payments in parking has fallen even further to almost 5 percent.

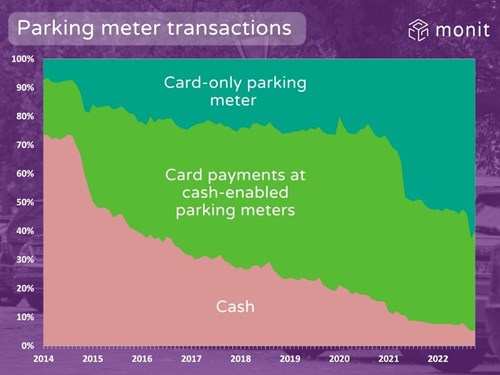

Trend in street parking payment methods.

The rapid growth of mobile parking payments comes from the many options available and the ease of paying with apps. We see the main replacement of cash in parking is with mobile payments. It’s true that more and more cities are removing cash payments at street vending machines – the number of transactions at vending machines where you can no longer pay with cash has increased from about 5 percent to 60 percent in the last 5 years – but also sees that there is more often a replacement by mobile than by debit/credit card.

In addition to the convenience of applications for end users, a good base payment infrastructure it is also important to the success of mobile payments. In the Netherlands, for example, the SHPV data “service house” contributes to the ease with which mobile payment providers can connect with public and private parking operators.

Cash payments still occupy a greater weight where the number of foreign visitors is higher, such as in touristic countries with a seasonal pattern. In the Netherlands these can be found on the North Sea coast and in towns along the border. This is not surprising knowing that in some surrounding countries, especially in Germany, the use of cash is still much more common when making purchases.

“This analysis says a lot“, emphasizes Bos. “With cash payments, purchased parking time often depends on what people have in their wallet. Moreover, one does not know in advance what the parking time will be. The latter also applies to debit card payments. With the trend of moving from cash to mobile payment and therefore in and out, we also have a much better picture of the actual parking behavior of motorists. And this in turn is important information for the management of parking operators and for the implementation of policies. Moreover, accepting mobile parking also offers financial advantages for municipalities. After all, cash payments are relatively expensive, such as the costs for cash deposits, and the investment and maintenance of parking meters that need to be able to accept cash. Cash is also more susceptible to fraud.“

‘The use of mobile payments in parking is significantly ahead of other sectors.

In short, says Bos: “This is an interesting development for us and for the parking market as a whole: traditional payment methods increasingly value-added payment applications are disappearing and emerging. Looking to the future, we expect that the way we pay in everyday life will continue to change, and therefore also for parking.” ABOUT parking operatorsexpects Bos, this means they will have to deal with even more systems, devices and platforms to incorporate different payment options. “For example, the first MaaS Providers are also discovering parking, for example Gaiyo, and payment options are expanding even further.”

The step to use parking data for policies can also be highly automated, Bos concludes: “Through us Parking monitor, the dashboard, our customers get a clear overview of all payment methods and they can perform their own analysis and thus optimize their policy. After all, if you as an operator know which channel is most important for which target group, you also know what to focus on to realize the goals of your mobility policies. And then I haven’t even mentioned the wealth of (open) data that is becoming available through linking parking data and EV charging behavior of drivers. That might be something to discuss next year.”

Meet Mon’s data

Monit Data provides data-driven insights into parking and mobility for public and private parking operators. If you would like to learn more about financial analysis and other services on our platform, we look forward to meeting you at one of this year’s international conferences. Monit Data will have a booth June 28-29 at Parken 2023 in Wiesbaden (Germany).

This article was written in collaboration with ‘Trend Book Mobility’. In the Trend Book you can read more about the latest developments and expert views about the very dynamic field of mobility. A topic that is important to all of us, both from our professional expertise and the way we as individuals experience the environment in which we live.

Trend Book Mobility 2023 contains 41 interviews with government, research and solution provider parties. You can read the entire trendbook for free via this link (Dutch only).

About Mon’s data

.png) Monit Data provides parking data analytics services for municipalities and private operators. User-friendly dashboards provide clear information on car, EV and bike usage. Use data-driven insights for urban mobility policies and day-to-day operational management.

Monit Data provides parking data analytics services for municipalities and private operators. User-friendly dashboards provide clear information on car, EV and bike usage. Use data-driven insights for urban mobility policies and day-to-day operational management.

[ad_2]